In the calendar year (CY) 2020 for the “Value-based insurance design” (VBID) Model and has expanded opportunities for CY 2021 including a new hospice benefit. The VBID Model aims to increase health care quality and decrease costs for Medicare Advantage (MA) by leveraging financial incentives to promote cost efficient health care services and expand consumer choice. VBID also enables reduced cost sharing for high-value services in order to increase their use. The goal is to improve patient health and reduce health care spending. In simpler language, it means payors may require different beneficiary copays and cost sharing based on the perceived efficacy and cost of specific treatments or drugs.

The Affordable Care Act (ACA) allowed the Center for Medicare and Medicaid Innovation (CMMI) to establish guidelines to permit a health insurance plan to use value-based insurance design in the MA program. The 2017 MA VBID program waived a uniformity requirement that precludes insurers from offering different benefits and cost sharing to enrollees in the same plan. This allowed participating insurers in eligible states to offer reduced cost sharing for high-value services or providers and/or offer supplemental benefits to beneficiaries with specific chronic conditions. Insurers may require beneficiaries to participate in care management activities before becoming eligible for VBID benefits. CMS did not provide additional financial incentives to participating insurers. VBID includes four (4) key components to the service delivery model:

- Value-Based Insurance Design by condition, socioeconomic status, or both

- Rewards and incentives

- Medicare hospice benefit

- Wellness and health care planning (required for all VBID-participating plans)

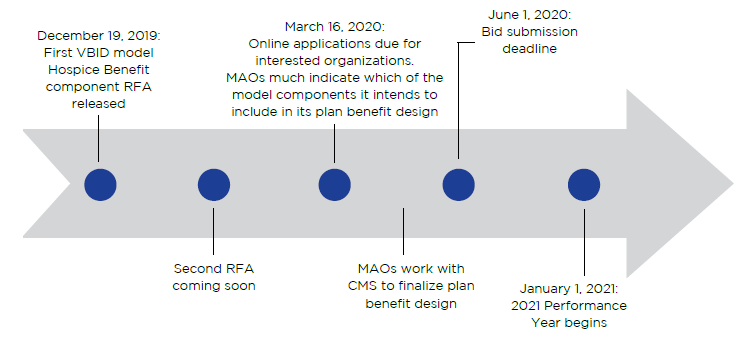

CMS is releasing the CY 2021 Model Request for Applications (RFAs) in two parts. In late December 2019, the CMMI announced its request for applications for the CY 2021 VBID Model application process. An updated request for application (RFA) is expected to be released soon. Applicants can apply for one or more of the VBID Model components. An important new section of VBID is an optional Hospice Benefit Component for participating Medicare Advantage organizations (MAOs) to include in their 2021 Part A1 benefits package.

In this article, we provide a framework to determine if your health plan or risk-bearing provider organization should opt into the 2021 performance year and elect the Hospice Benefit component. Decisions are at hand; applications with indication of model components are due March 16, 2020 and the final bid submission is due on June 1, 2020.

Figure 1. Timeline of VBID Model Framework

The Hospice Benefit Component

Simplifying coverage rules for hospice patients (by allowing these benefits to be “carved in” to the benefit plan) is anticipated to reduce complexity and improve safety and care coordination at the end of life, while moving the site of care from the hospital or skilled nursing facility to a dedicated hospice environment. A few key points on the new Hospice Benefit:

- How does the new Hospice Benefit affect interested payors?

- Interested parties are required to submit a strategy for providing palliative care for their members in order to participate in the Hospice Benefit Component.

- More holistic benefit design moves payors further away from the traditional fee-for-service (FFS) structure and creates a new ability to collaborate and incentivize beneficiaries to utilize contracted hospice providers.

- While more beneficiaries may elect to utilize hospice services, higher utilization and higher overall program costs are offset potentially by reductions in skilled nursing and rehabilitation facility costs.

- More appropriate site of hospice care utilization in the post-acute setting reduces the costs of a skilled nursing facility (SNF), in-patient rehab facility or even home health.

- Participation is voluntary, creating an increased risk in attracting higher cost members that may negatively influence overall plan performance.

- The limited availability of high-performing, high-quality hospice providers means that payors must evaluate existing networks, expand the hospice provider network as needed and partner with the highest-performing and top quality hospice providers.

- How does the Hospice Benefit affect providers (integrated delivery networks (IDNs), medical groups, and SNFs)?

- There will be increased accountability regarding attributed beneficiaries as the quality and cost of care will have a greater direct impact on performance.

- Providers and provider groups will have an increased ability to control which hospice providers are utilized by beneficiaries and to recommend contracted and/or in-network providers.

- Improved communication between patients and providers can greatly enhance safety, coordination-of-care and beneficiary satisfaction at end-of-life transition.

Beyond the important new Hospice Benefit however, the available analyses of VBID in implementation years 2017-2019 have evidenced mixed results that may affect payors’ interest in participation in 2021:

- Data on VBID results is limited. While early results have been largely promising, high quality, longitudinal data about the effectiveness of value-based insurance design is limited.

- There is a dearth of actuarial data on impact of likely changes in utilization. Participants need information to develop realistic assumptions, particularly about the impact of beneficiary selection, changes in utilization and savings. However, most actuarial data is generated on the employed population younger than 65 years of age. Extrapolating to the Medicare population is not applicable.

- VBID cost savings may be minimal and may necessarily focus on maximizing long-term outcomes. The optimal focus of VBID is a focus on population health, better quality of life and lower long-term costs, such as decreased hospitalizations and emergency department use.

- Strategies to minimize implementation costs are important. To increase the chance of a positive return on investment, several participants relied on existing programs and processes when possible, which helped them design interventions that were easier and less costly to implement.

- Participants must coordinate multiple internal departments. If the participant’s bid were to require beneficiaries to engage in care management, a variety of departments that may not have previously communicated or worked together must coordinate.

- Current data on beneficiary selection muddies potential conclusions on efficacy of interventions. Beneficiaries in VBID-participating plan benefit packages (PBPs) who are eligible for VBID benefits are different from ineligible beneficiaries across most comparisons. Eligible beneficiaries are generally older, more likely to be male, more likely to be White or Hispanic, and more likely to be dually eligible for Medicare and Medicaid. Eligible beneficiaries also have, on average, significantly higher risk scores (1.5 versus 0.9) and are more likely to have cancer, congestive heart failure (CHF), chronic obstructive pulmonary disease (COPD) and diabetes. Because CHF, COPD, and diabetes are targeted by one or more VBID-participating organizations, it is not surprising that a higher proportion of eligible beneficiaries have these conditions.

- Administering two sets of benefits to beneficiaries within the same plan requires IT sophistication and internal systems to identify, track and administer VBID benefits. Under VBID, beneficiaries in the same plan may get different benefits, depending on their diagnoses. Diagnosis with an eligible condition midyear could trigger a change in benefits. Identification of those VBID-eligible members and administering targeted benefits to them specifically and not to the general population is complex. Two obvious complexities include tracking of claims and administration of benefits exactly according to the bid submission.

Medicare Advantage health insurers and provider groups have proven their willingness over the years to invest in the innovation that supports care improvement, benefit design enhancement and be a leader in the MA space. VBID could offer membership growth opportunities for interested and viable organizations. With the March 16, 2020 application deadline looming, rapid evaluation of the various factors, such as those outlined in this article, is critical as organizations consider whether they make good candidates for the VBID Model.

Endnotes

1 Medicare Part A, also known as “Hospital Insurance,” covers inpatient care, skilled nursing facility care, hospice care, and home health care.