The survey commissioned by Change Healthcare and HealthCare Executive Group and conducted by InsightDynamo provides some excellent insights. It is interesting to see where payors and providers in the study align and where they differ. Here are the key takeaways:

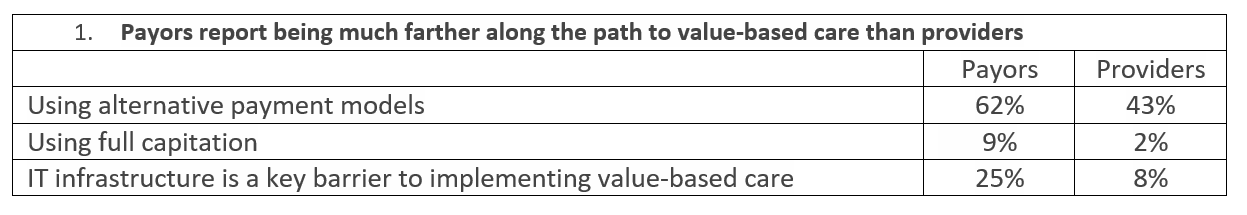

“Alternative payment models” is a term that applies to a broad range of reimbursement schemes. Some of these pay incentives are for implementing process metrics (like completing a patient health risk assessment); some are outcome-based (like reduction in mortality rates); some include provider penalties (like hospital-acquired conditions). The financial influence on providers might be significant or negligible. The good news is that alternative payment models are on the radar screen of both payors and providers.

Medicare and Medicaid continue to shift to managed care models in which health plans receive capitation such that CMS and states limit their financial exposure and improve quality. While there are regions of the country where risk models are predominant, it appears the vast majority of payments are from volume-driven fee-for-service agreements. The use of quality metrics is more commonplace.

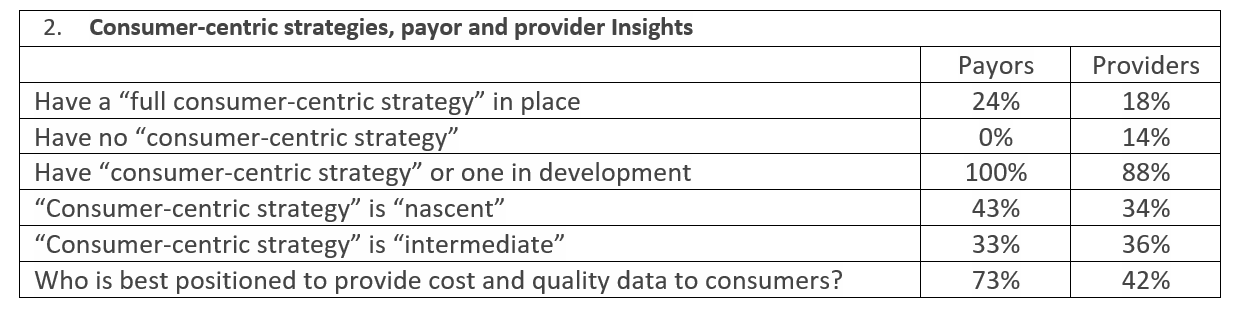

There is a significant focus on patient satisfaction. That said, the definition of a consumer is “a person who purchases goods and services for personal use.” Health care is very personal, but most patients are insulated from the real cost of health care. The reality is that few can afford health care and selecting the right health care option is not as easy as trying on a pair of shoes or going for taking a car for a test drive.

The issue of personal responsibility is intimately entwined with health care. Most consumers take better care of their cars than they do care for themselves. Three behaviors—poor diets, physical inactivity and smoking—contribute to four chronic diseases: cancer, heart disease, stroke, diabetes and respiratory conditions. These four buckets account for over 50 percent of death worldwide. Consumer-centric health care is a step in the right direction but work needs to be done to evolve beyond consumer-centric strategies to understand better how to motivate health care consumers to live healthy lifestyles.

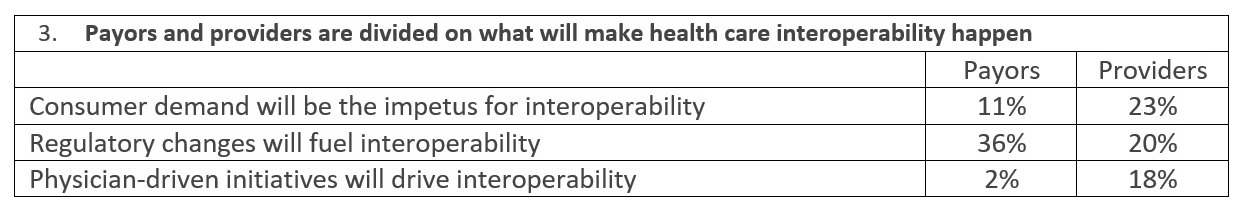

HIMSS defines interoperability as the ability of different information systems, devices and applications (‘systems’) to access, exchange, integrate and cooperatively use data in a coordinated manner, within and across organizational, regional and national boundaries, to provide timely and seamless portability of information and optimize the health of individuals and populations globally.

It is hard to imagine true interoperability occurring in our lifetimes. Americans are justly concerned about their privacy. Countries are sponsoring hacking operations for the purposes of large-scale identity theft. Health care firms continued to be the primary targets of cyber-attacks with data breaches and ransomware incidents.

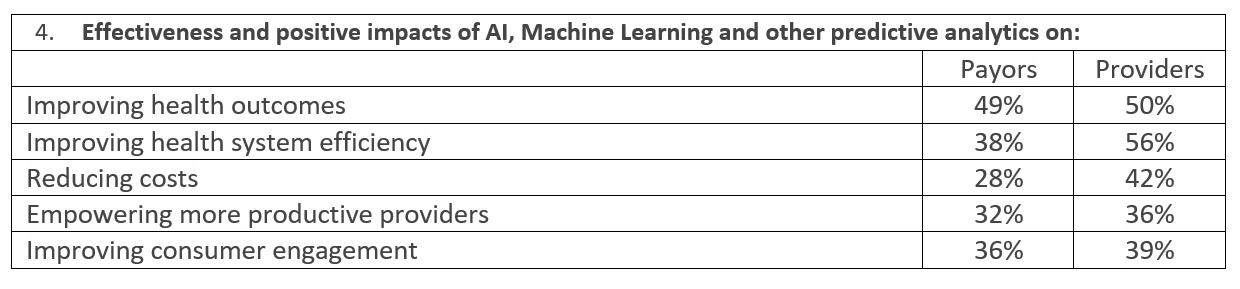

Large payors and health systems will be the first to benefit from these technologies but expect the cost to come down over time as more systems move to the cloud. Eventually, many of the powerful analytical and predictive tools and the expertise necessary to obtain the benefits these systems provider, will be affordable and available across the industry.

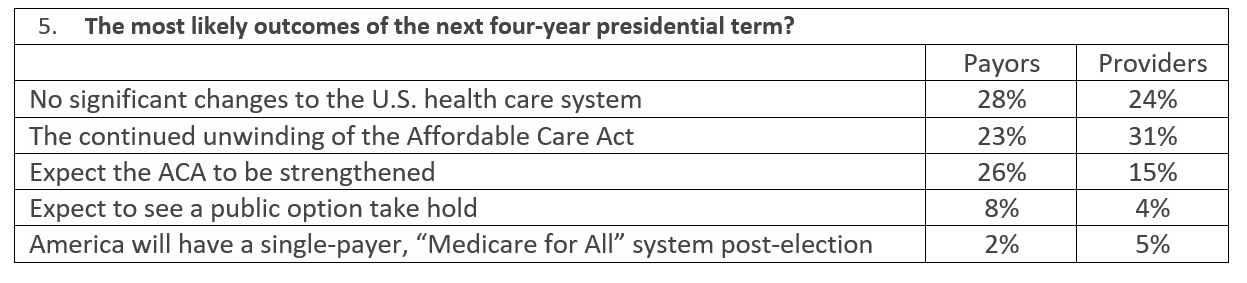

Health care has become a major focal point of the November 2020 election. There are multiple scenarios. Watch not only who is elected to the White House but also which parties control the House of Representatives and the Senate. A sweep by Republicans would mean a replacement of the ACA; a Democratic sweep would mean a strengthening of the ACA. Besides the election, we also need to keep an eye on the Supreme Court.

Regardless of who is in control of the White House and Congress, health care costs continue to outpace the consumer price index (CPI). The percent of Americans ages 65+ over as a percentage of the population will increase by 3.7 percent to 20.6 percent by 2030. Pharmacy costs are out of control. The vast majority of health care in the U.S. still fee-for-service and still engineered to chase volume. To battle rising health care costs, the shift to value-based care will likely continue and intensify.

Comments? Questions? Please reach out to Tom Dougherty at tdougherty@copehealthsolutions.com or join the conversation by following COPE Health Solutions on social media.