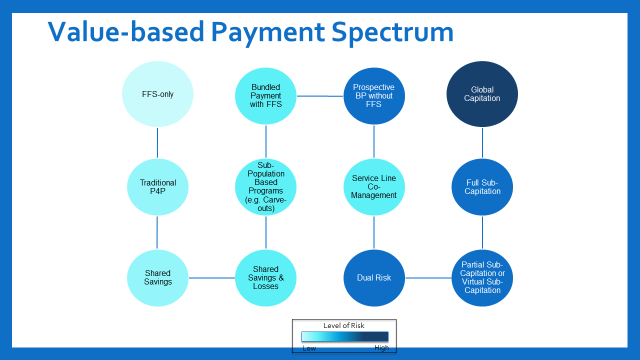

The national trend across all lines of business toward more risk arrangements means most health systems and physician groups are operating in pluralistic payment environments. They earn some of their revenue through traditional fee-for-service and other portions come from shared savings, bundled payments, capitation and other value-based payments.

Figure 1: Payment System Spectrum

While this mixed approach has supported the move toward value-based care, some health plans are pushing to accelerate progress through more value-based payment (VBP) contracts that include both upside and downside risk. Both commercial insurers and the Centers for Medicare & Medicaid Services are deemphasizing shared savings programs, seen as starter VBP arrangements, because payers perceive them to be less successful at changing behavior.

For health systems, moving a significant portion of their book of business into global budget risk or capitation arrangements can present a difficult situation because lost revenue from reduced volume of traditional admissions must be made up elsewhere within the system. For medical groups, taking global or capitated risk can be challenging in markets with highly consolidated hospital systems and a lack of good partners.

At the same time, the pandemic has underscored some advantages of a global or capitated risk contract.

Keys to Successful Shift to Global Risk

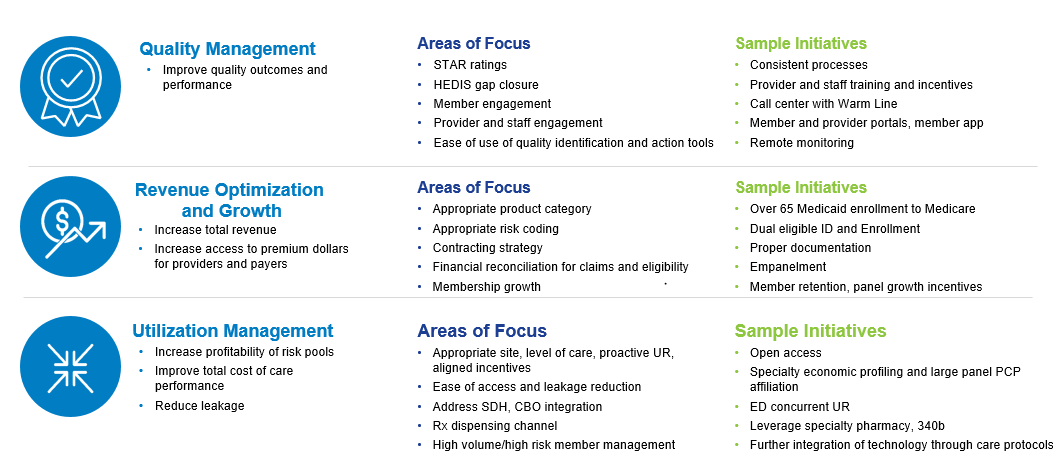

It is becoming critical for providers to develop a roadmap to VBP success, characterized by a gradual shift from traditional revenue streams based on volume of services to profitable capitated lines of business. To excel in this payment environment, health systems and physicians must address three key value drivers:

- Revenue optimization

- Quality management

- Clinical efficiency

Doing so requires a new level of collaboration with other providers across the care continuum. Robust data and analytics are also needed to help focus providers on the right efforts to ensure a positive margin. And providers need the right infrastructure to support quality and cost improvement.

The infrastructure required to optimize revenues, manage quality and improve clinical efficiency can coordinate with opportunities to negotiate rewards for reducing cost and utilization and managed care contracts. Well-negotiated managed care contracts can help ensure that successful performance and utilization management will lead to pass-through revenue savings to physicians and dollars to reinvest in core infrastructure.

Steps for Building a VBP strategy

1. Understand in great depth the flow of current dollars into and out of the provider organization.

Providers can use existing available claims and cost data to determine the flow. Today, health systems and providers navigate a complex mix of reimbursements, including discounted FFS, diagnostic related groups (DRGs), per case payments, bundled payments, supplemental payments (such as disproportionate share hospital dollars) and other payment methodologies. Safety and quality of care performance metrics, readmission penalties, CMS initiatives and bundled payments are other common examples of simple risk and quality payment arrangements. Each of these has its own infrastructure implications, system burdens and positive and negative incentives.

2. Assess the opportunity to enhance performance under current risk contracts.

Before providers can pinpoint improvement opportunities, they first must understand:

- Financial and nonfinancial incentives already in place, both favorable and unfavorable.

- Current revenue and spend impacts at the level of individual physicians, hospitals and other key providers.

- Cost, utilization, and quality of both the network and the other physicians and facilities that their patients are visiting.

Analyzing the right data can deliver these insights. By using claims, HIE, SDOH, and other EMR data, a health system can see where its patients are utilizing services both within and outside of its network and better determine network performance by care settings and specialties. Drilling down into practitioner-level detail for all network and out-of-network providers caring for their patients also can provide important information for improving population health management and performing well in value-based arrangements. For one, it can inform strategies for incentivizing the best performers across the network to develop a well-aligned coordination of care.

3. Develop a validated forecast of the actual impacts of key initiatives.

Developing fact-based scenarios and models will gain buy-in from key stakeholders. Setting target benchmarks using peer performance is an important initial step when trying to culturally shift a health system and its practitioners. The most successful health systems are able to navigate the myriad upside opportunities and downside risk measures they are engaged in by identifying a common set of key initiatives that will drive success across the various metrics.

Figure 2: Three Key Value Drivers for Risk Contracts

4. Develop a multi-year pro forma based on validated claims and cost data.

To demonstrate the actual impact of key initiatives, the pro forma will assess:

- Appropriate enrollment of current and prospective patients and members in the product optimally designed for their needs (e.g. Medicare Advantage vs. traditional Medicare; Medicaid or the other Affordable Care Act products).

- Optimal opportunities for high-risk member management, initially determining “impactable” members and high-risk member density mapping against available providers.

- Contracting opportunities to measurably improve payer STAR ratings based on improved quality and reporting, as well as provider aligned incentive programs; fee schedule and risk-adjusted capitated payment negotiation and reinsurance thresholds.

- Revenue enhancement initiatives, such as correct coding optimization, call management, formulary development and UM optimization.

- Facilitated member access to the most appropriate site of care, including initial empanelment to high-performing PCPs and specialty providers, reducing network leakage to non-system specialists, as well as e-consult availability for PCPs.

Leverage Granular Data and Analytics

Hospitals and health systems vary significantly in terms of geography, services and patient population, which creates the need for understanding the data at a local level. Rigorous data analytics evaluates the costs, risks and revenues based on proposed population characteristics, associated cost, savings opportunities and threats to profitability.

Analytics will highlight short-term opportunities to fine-tune current FFS payments to incentivize reductions and utilization. Additionally, network leakage statistics provide the indicators of gaps in provider access and highlight referral patterns that can bleed finances with out-of-network hospitalizations, specialty care and home or community-based care.

The ultimate goal must be sustainable success in managing the dollars at-risk for defined populations. Deficiencies in operational, utilization and referral management, claims administration and clinical information technology will jeopardize well-intentioned population health strategies.

To that end, leadership should assess current management services organization (MSO) capabilities against what is necessary to profitably manage and administer a capitated population. Population health infrastructure build, including MSO services, new data systems and integration of health records with community care partners, must be phased in gradually to ease system transition.

Taking financial risk is complex – there is no one-size-fits-all approach. Moving deliberately but not immediately to downside risk in contracts allows providers and payers time to negotiate delegation of responsibility and adequate dollars to make the agreement attractive for both parties.

A robust roadmap based on rigorous data analytics and a cultural discipline around leveraging payer claims data to inform strategies is indispensable for long-term success.

For more information, please contact info@copehealthsolutions.com.