Introduction

The federal government has announced multiple grant and loan funding opportunities to aid health care providers facing increased expenses and lost revenues due to the Covid-19 pandemic. It is anticipated that additional federal funding will become available as the pandemic continues.

Many of these funds, however, are first-come, first-served. Health care providers need to prepare now to ensure they are at the front-of-the-line to apply and receive disaster relief funding. Similarly, physicians, physician groups and other health care providers must consider thoughtfully the necessary documentation required for reporting on the use of funds and potential future audits for both grants and loans.

This article identifies recent funding made available for physicians and physician groups and discusses compliance considerations in order to both survive and thrive during this time.

Available Funding Opportunities for Physicians and Physician Groups

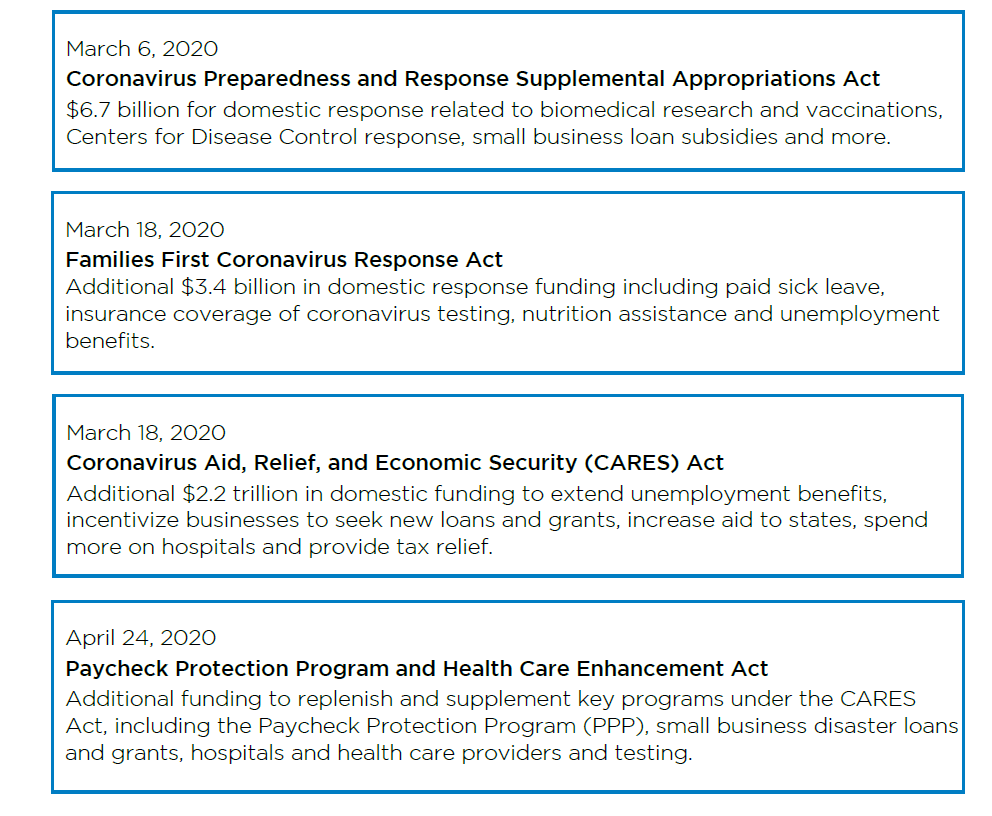

In response to Covid-19, the federal government has released four key pieces of legislation to date in an effort to combat the pandemic.

Grants

The majority of grant opportunities available for physicians, physician groups and other health care providers, are found within the CARES Act and the Paycheck Protection and Healthcare Enhancement Act. Together, these two pieces of legislation offer $175 billion in grants through the Provider Relief Funds. All health care entities that provide care to Medicare or Medicaid patients are eligible for funding. Additional funding mechanisms, such as Medicare payment boosts, advance payments, accelerated payments, support for community health centers and additional appropriated funding are also included in the laws.

Of this $175 billion, $50 billion of the Provider Relief Fund has been allocated to date for general distribution to facilities and providers impacted by Covid-19 based on eligible providers’ 2018 net patient revenue.

$30 billion of this fund was automatically distributed in early- to mid-April based on Medicare fee-for-service reimbursements in 2019. Payments arrived via direct deposit beginning April 10, 2020, and these funds will not need to be repaid. However, organizations that received more than $150,000 must submit a quarterly report to Health and Human Services explaining how the funds are used.

To make funding more equitable to providers that see few traditional Medicare patients, $20 billion is being distributed to providers to augment their original allocation so the whole allocation of $50 billion will be proportional to providers’ share of 2018 patient revenue. Providers with CMS cost reports will be sent an advance payment based off revenue data they submitted. Those without CMS cost report data will need to submit their information to a portal. Payments will be distributed weekly and on a rolling basis as information is validated.

Remaining funds from the CARES Act have been made available for the treatment of the uninsured, Covid-19 high impact areas ($10 billion), rural providers ($10 billion) and Indian Health Service ($400 million).

The $75 billion within the Paycheck Protection and Healthcare Enhancement Act is to prevent, prepare for and respond to coronavirus, domestically or internationally for necessary expenses to reimburse through grants or other mechanisms, eligible health care providers for health care related expenses or lost revenues that are attributable to Covid-19. The funding has not yet been allocated.

Loans

Physicians and physician groups should focus on three loan programs currently offered: the Paycheck Protection Program (PPP), Main Street Lending Program (MSLP) and Economic Injury Disaster Loans (EIDL).

The original allocation of $349 billion in PPP funds from the CARES Act was quickly depleted. Recognizing the popularity and necessity of the program, Congress passed the Paycheck Protection Program and Healthcare Enhancement Act, which included $310 billion to replenish the Paycheck Protection Program. As of early May, the Small Business Administration (SBA) estimated that 40 percent of the second tranche of funds are still available. Health care providers with less than 500 employees, sole proprietors, independent contractors and other self-employed individuals are eligible and encouraged to apply for funds. Relevant expenditures include payroll costs, costs related to continuation of health care benefits, employee compensation, mortgage interest obligations, rent, utilities and interest on debt incurred before the coverage period.

As of mid-May 2020, the SBA released guidance to apply for loan forgiveness of PPP funds earned. The application has four components, including the PPP Loan Forgiveness Calculation Form, PPP Schedule A, the PPP Schedule A Worksheet and the PPP Borrower Demographic Information Form, of which the last is optional. Borrowers will be responsible for submitting their forgiveness application to their lender either online or through a physical copy and their bank will have 60 days to approve or reject the forgiveness request.

The Main Street Lending Program (MSLP) aims to support lending to small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 pandemic through the Federal Reserve. MSLP will operate through three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF) and the Main Street Expanded Loan Facility (MSELF). U.S. businesses may be eligible for loans if their business has 15,000 employees or fewer or had 2019 revenues of $5 billion or less. Loans issued under the program would have a four-year maturity and principal and interest payments on the loans will be deferred for one year. Although the program is not yet operational, small and medium-sized businesses interested in the program will be able to apply soon for loans by contacting an eligible lender.

Within the Paycheck Protection and Healthcare Enhancement Act, Congress added an additional $10 billion for EIDL grants ($10 billion was previously allocated within the CARES Act) to remain available until expended to prevent, prepare for and respond to Covid-19. EIDL grants can be requested for up to $10,000 per entity. However, as of mid-May, funds available for the program have been depleted and the Small Business Administration is only accepting applications from agricultural businesses.

Future Sources of Funding

Additional funding may be available soon. On May 15th, the House of Representatives passed the HEROES Act, a new $3 trillion bill with $100 billion set aside specifically for health care providers. Instead of adding this funding to the Health and Human Services $175 billion Provider Relief Fund, the House of Representatives added more stringent rules to the allocation, requiring providers to track revenue loss and increased expenses and submit them for reimbursement. While this bill may not be enacted into law, it is important for providers to record their expenses and revenue losses related to Covid-19 for future reimbursement, since these more stringent guidelines may make their way into future allocations for health care providers.

Audit and Compliance Considerations

With many grant and loan funding opportunities available, physicians and physician groups must plan for compliance and document retention during the application process. Audits are anticipated to occur within three to five years of receiving funds, and quarterly reporting requirements have been instituted for specific grant opportunities. Each release of funds may have individualized terms and conditions for using the funding, and some are broader than others.

For audit and reporting purposes, physicians and physician groups should match funding sources to expenses, placing priority on more restrictive funds, like using PPP on payroll expenses, followed by allocating more lenient funds, like the CARES Act General Allocation grants, to fill in gaps, such as rent. Similarly, terms and conditions of attaining funding may change, and “double dipping”, or using two separate sources of funding for the same expense, should be avoided. Double-utilization of funds will be most concerning for funding sources that are highly restrictive and come from multiple sources, such as telehealth funding.

Taking Action

While this pandemic has brought about many challenges, there are ample opportunities for physicians and physician groups to endure and even flourish. The first step to withstand the emergency is being knowledgeable and taking action to access emergency funds through tracking of available opportunities and collection of necessary documentation. Similarly, monitoring changes in legislative allocations, applications and terms and conditions will help to prepare for reporting requirements and the certainty of an audit.

Funding availability and regulation is in constant flux. COPE Health Solutions has deep expertise in identifying the best-fit options for physicians and physician groups to earn the most funding they can during this time. COPE Health Solutions has substantial experience helping hospitals, health systems and provider groups draw down federal and state funds through grants, waivers and other programs. Our experts have led organizations through disasters and are experienced in the nuances of securing disaster relief funding. COPE Health Solutions has already helped a multitude of clients review their options during the Covid-19 pandemic and submit required applications.

For more information, please reach out to info@copehealthsolutions.com or call 646-768-0006.