Program Structure and Features

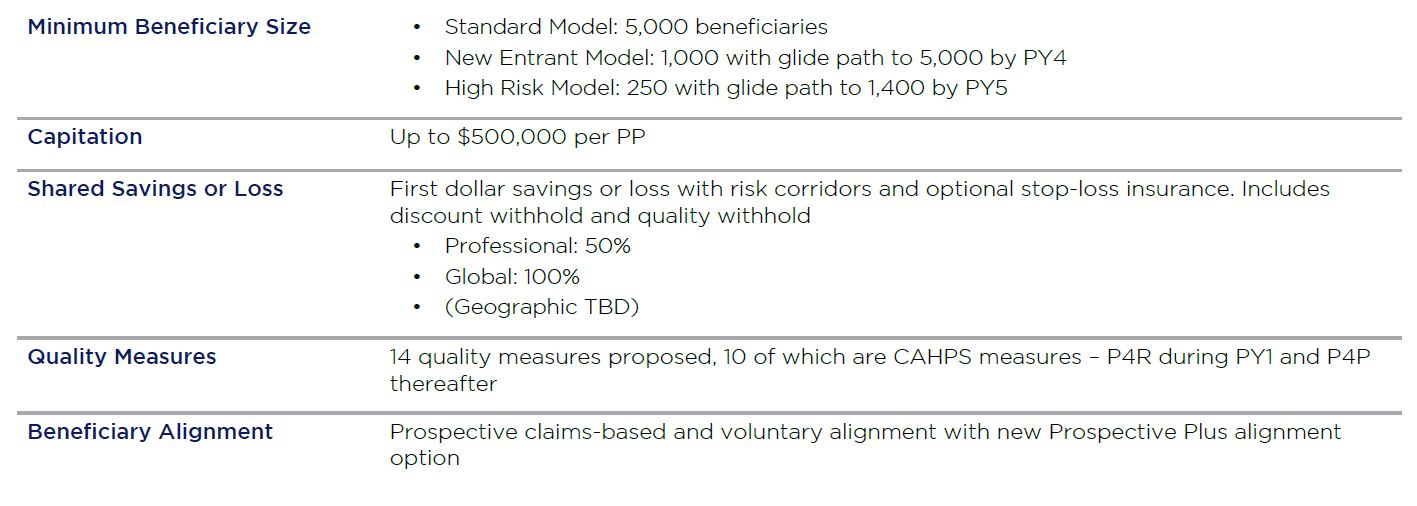

CMS launched Medicare Direct Contracting (MDC) in 2019, giving providers and payers an opportunity to take risk and manage population health for Medicare fee-for-service (FFS) beneficiaries. Although the program builds on existing features of accountable care organization (ACO) models, payments under MDC will be based on partial or full capitation.

To participate in the MDC program, organizations must establish a legal entity called a Direct Contracting Entity (DCE). On signing the agreement to participate in the program, the DCE must meet criteria outlined by the Center for Medicare and Medicaid Innovation (CMMI) in the request for applications (a primary criterion being the ability to contract downstream with the DCE provider network). Organizations can establish DCEs independently or in partnership with other organizations. Eligibility extends to a broad swath of provider types. The aim is to attract a diverse pool of entities, including existing Next Generation ACOs, Shared Savings Program ACOs and Managed Care Organizations (MCOs) with fully integrated and dual plans.

Applicants to the Professional and Global models must choose from among three DCE types:

- Standard – for providers with experience delivering care to at least attributed 5,000 Medicare FFS beneficiaries

- New entrant – for providers with less experience in Medicare FFS and the ability to gain a minimum of 3,000 attributed FFS beneficiaries in their first performance year (PY) and 5,000 by PY4

- High-needs population – for providers with target populations that meet the criteria for “high needs” for Medicare, can meet the threshold of 250 in PY1 and can grow to 1,400 by the end of PY2

Eligibility for these types is driven by current experience with risk, required beneficiary alignment volume and desired target population to be managed within the program.

Exhibit A: Medicare Direct Contracting Program Features

Medicare Direct Contracting Payment Models

In addition to selecting a DCE type, applicants must select a specific payment model. The MDC program currently comprises two voluntary risk-sharing payment models, designated as professional and global. A third geographic model is also available, separately released in December of 2020. Although details are not final, this option targets more mature risk-bearing organizations and would offer DCEs the ability to assume risk for the total cost of care for Medicare FFS beneficiaries in a CMS-approved geographic area using a geographic assignment methodology.

The two active MDC models are:

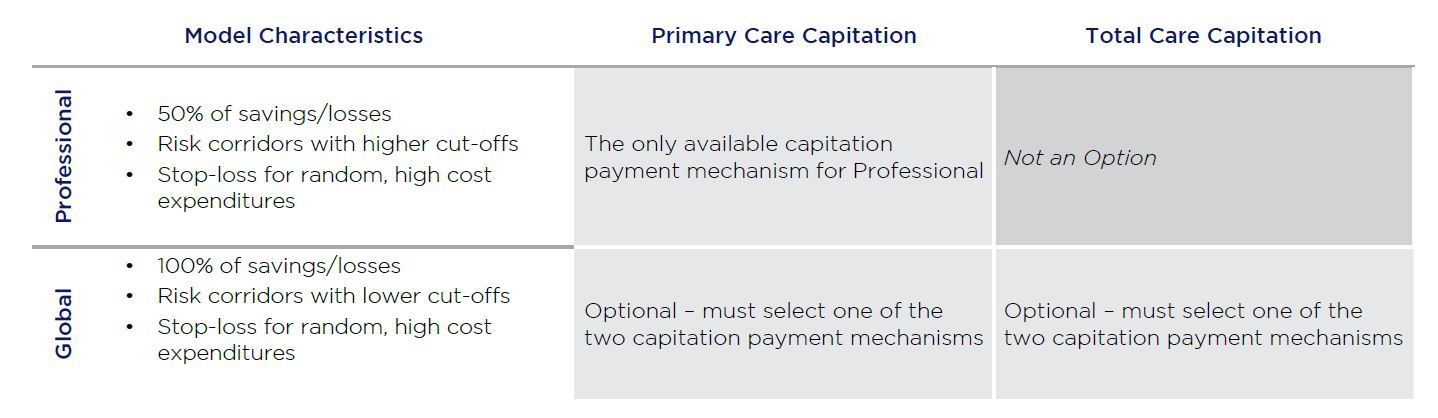

Professional

This population-based payment option offers a 50% savings/losses risk-sharing arrangement with risk corridors protecting against significant swings in cost, on the total cost of care. DCEs choosing this option receive primary care capitation, with a risk-adjusted per-beneficiary-per-month (PBPM) priced at 7% of the total cost of care. CMS’s assumption is that this pricing will likely be higher than a DCE’s baseline primary care cost, thereby providing a temporary advance payment to cover enhanced primary care services. After the performance year and before shared savings or losses for the year are calculated, CMS will recoup any of the 7% PBPM capitation over and above baseline so it will not skew the total cost of care savings or loss calculation. This reconciliation against baseline is independent of actual expenditures. For example, if baseline is 5%, CMS will recoup 2% (7% – 5%), even if DCE actual expenditures are greater or less than the 5% baseline.

Global

This payment option offers 100% risk-sharing of savings or losses, again with risk corridors, against the total cost of care. It also offers a choice of primary care capitation, with the same recouping rules as per primary care capitation in the Professional option above, or total care capitation – for which there is not a recoupment of capitation outside of the shared savings/loss reconciliation. A risk-adjusted PBPM payment covers all services provided by the DCE and the preferred providers with which the DCE has an agreement.

Exhibit B: Currently Available Payment Models for Direct Contracting Entities

Participants in MDC can choose either professional or global risk for any of the standard, new entrant or high-risk options. Each model spans five years plus an optional initial implementation period to align sufficient Medicare beneficiaries. The initial implementation period for the first two models began in January 2020 and the first performance year is 2021, with a start in April due to Covid-19 related delays. The next application cycle will begin in the first quarter of 2021 for a January 1, 2022, performance year.

For more information on exploring Medicare Direct Contracting, please contact Shanah Tirado at stirado@copehealthsolutions.com or 213-369-7415.