A year ago, we explored the first results of the Global & Professional Direct Contracting (GPDC) program¹ (renamed to ACO REACH for performance year 2023) and found four themes:

- Most participants could have earned greater savings by selecting a different risk arrangement (Professional or Global);

- “New Entrant” REACH ACOs tended to earn larger savings than their “Standard” ACO counterparts;

- “High Needs” ACOs achieved the greatest savings per beneficiary month; and

- The risk and reward trade-offs with ACO REACH are significant.

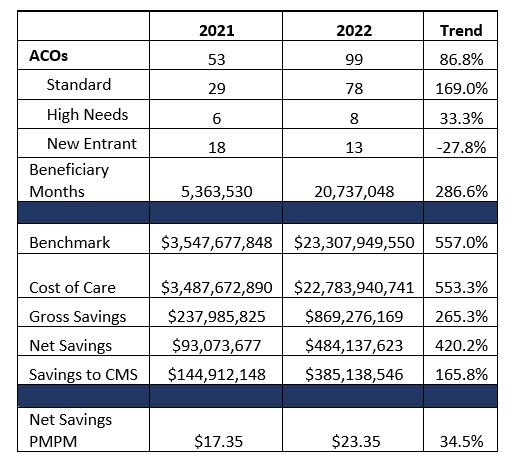

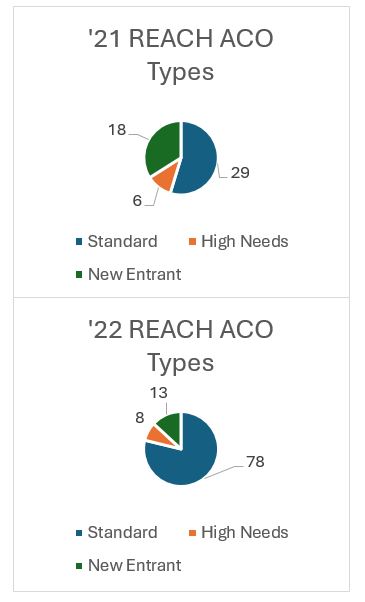

You may recall that the initial start of the GPDC program was postponed due to uncertainty and resource constraints caused by the COVID-19 pandemic. For the same reasons, the initial contract period for the MSSP program was amended to include an optional fourth year of participation, allowing providers additional time to decide between an additional three-year MSSP contract, transitioning to GPDC/ACO REACH, or reverting to FFS. These unexpected events tempered the participation for the first year of the program and caused the number of ACOs participating in the second year to nearly double from 53 to 99. Given the change in landscape, we were interested to see if the same insights held true or if others were present in the data.

A year ago, we explored the first results of the Global & Professional Direct Contracting (GPDC) program¹ (renamed to ACO REACH for performance year 2023) and found four themes:

- Most participants could have earned greater savings by selecting a different risk arrangement (Professional or Global);

- “New Entrant” REACH ACOs tended to earn larger savings than their “Standard” ACO counterparts;

- “High Needs” ACOs achieved the greatest savings per beneficiary month; and

- The risk and reward trade-offs with ACO REACH are significant.

You may recall that the initial start of the GPDC program was postponed due to uncertainty and resource constraints caused by the COVID-19 pandemic. For the same reasons, the initial contract period for the MSSP program was amended to include an optional fourth year of participation, allowing providers additional time to decide between an additional three-year MSSP contract, transitioning to GPDC/ACO REACH, or reverting to FFS. These unexpected events tempered the participation for the first year of the program and caused the number of ACOs participating in the second year to nearly double from 53 to 99. Given the change in landscape, we were interested to see if the same insights held true or if others were present in the data.

One of the most interesting findings from the 2021 data was that most of the REACH ACOs (58%) selected a risk track that either reduced their realized savings or expanded their realized losses. A number of factors could have contributed to this occurrence; novelty of the program, New Entrants lacking a baseline population to inform their risk arrangement selections, and the uncertainty that existed due to the pandemic’s impact to utilization patterns. The data from 2022 suggests that ACOs are gaining a better understanding of the program mechanics and the populations they service as they gain experience.

In 2022, we found that 66% of the new participants to the program and 70% of all participating ACOs selected the most beneficial risk arrangement for the performance in the period. Those that selected the less optimal risk arrangement in 2021 largely adjusted their performance or risk arrangement to earn an additional $141 million in 2022. As a whole, the participants that continued participation into 2022, regardless of risk arrangement selection, earned an additional $252 million than in the year prior. This group of ACOs continuing participation accounted for 65% of the total earnings and 37% of the total membership in 2022. Although, two of these REACH ACOs elected to remain in the professional risk arrangement in 2022 when the global track would have earned them an additional $7.7 million.

In 2022, we found that 66% of the new participants to the program and 70% of all participating ACOs selected the most beneficial risk arrangement for the performance in the period. Those that selected the less optimal risk arrangement in 2021 largely adjusted their performance or risk arrangement to earn an additional $141 million in 2022. As a whole, the participants that continued participation into 2022, regardless of risk arrangement selection, earned an additional $252 million than in the year prior. This group of ACOs continuing participation accounted for 65% of the total earnings and 37% of the total membership in 2022. Although, two of these REACH ACOs elected to remain in the professional risk arrangement in 2022 when the global track would have earned them an additional $7.7 million.

Four ACOs exited the program after the first year of participation. Combined these ACOs suffered a net loss of $7.6 million, although not all four incurred losses. Three of the four ACOs were New Entrant ACOs. This is interesting given that our findings from the 2021 year indicated that New Entrants performed better than their Standard ACO counterparts. This remains to be true when looking at the group of ACOs in the aggregate. Some familiar names stand out as the high performing outliers lifting the New Entrant category as a whole. Historically these are organizations that have operated primarily in Medicare Advantage value-based arrangements with a high-touch clinical model. These ACOs accounted for nearly two-thirds of the total earnings in 2021 and earned even more in incentives in 2022.

These high-performing ACOs will gain experience and transition to the Standard ACO category overtime but should be tracked exclusively given the significant variation in their performance. If they are able to continuously outperform other ACOs, as indicated by these limited two years of performance data, then other ACOs should evaluate the differences in their own care models and those of the high performers. The high-performing ACOs tend to have care models that are similar to those that serve the High Needs populations, the other ACO type that continues to outperform.

Conclusion

Variation between ACOs exists across all categories and ACOs from each category have incurred both gains and losses, some substantial. The above analysis shows that most providers are no better than a flip of a coin at predicting their expected performance and selecting the optimal program and risk profile. The data and methods exist to do better. Provider groups considering the transition to value-based reimbursement should consider engaging an advisor to prospectively evaluate network participants and attributed populations to better estimate savings and loss potential.

If you are considering joining an MSSP ACO or a REACH ACO, CHS can help evaluate your risk profile and estimate potential performance. Our team of experts can support your team in configuring your arrangement to best mitigate risk and maximize reward while subsequently designing a roadmap to optimize your operational and care models. Please do not hesitate to reach out at info@copehealthsolutions.com or 213-259-0245.</em