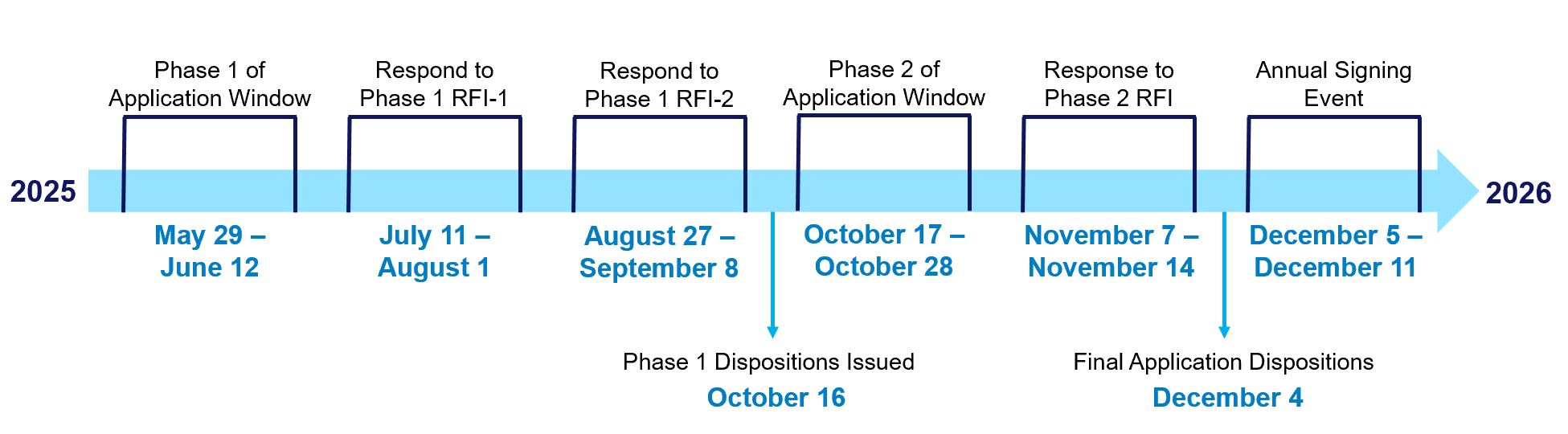

CMS has recently posted the Performance Year (PY) 2026 Application Dates for the Medicare Shared Savings Program, and as we rapidly approach Q2 of 2025, the time is now to start thinking about participating in the Medicare Shared Savings Program (MSSP) program in 2026. MSSP has long offered opportunities for physician networks to advance on their journeys to risk through enticing and attractive financial opportunities to form and participate in Medicare Accountable Care Organizations (ACOs). In PY 2023, a total of 456 ACOs covering 10.9 million beneficiaries earned a total of $3.1 billion in shared savings.1

Physician leadership should strategize now, considering the following key insights:

- Assess and Align on Your Organization’s Risk Readiness and Optimal Risk Track

Whether you are a new entrant or experienced provider, there are options in both the Basic and Enhanced tracks that aim to meet each ACO’s risk tolerance and provide a glide path from upside only to two-sided risk over time. Incumbent ACOs should evaluate shared savings performance, including how much is either left on the table or paid to ACO administrators.CMS launched a new program within MSSP in PY25 called ACO Primary Care Flex for low revenue ACOs that provides enhanced Prospective Primary Care Payments and a one-time Advance Shared Savings payment. It is unclear if CMS will open another application for PY26. PC Flex is particularly attractive for ACOs with smaller medical groups, FQHCs, and RHCs. - Strategize How MSSP May Serve as a Beachhead for Success in Broader Value Based Care Arrangements

MSSP offers an opportunity to enter a risk arrangement for Medicare Fee for Service (FFS) beneficiaries – providers should leverage the required population health infrastructure and capabilities to succeed in broader risk arrangements for other lines of business, including the dual eligible population. This requires detailed strategic planning and creating a roadmap to gain access to more premium through quality and total cost of care performance. - Own Your Own Data: Focus on Data Interoperability and Clinical Integration

CMS provides a wealth of data about the assigned population. ACOs must create the proper data governance structures to perform risk stratification that informs care management activities to best manage the population to achieve shared savings results.

At COPE Health Solutions we partner with provider groups to help them succeed in MSSP and other Medicare ACO models. Our partnership model is flexible to your organization’s’ needs ranging from:

- Population Health Analytics and Clinical Insights Support through our Analytics for Risk Contracting (ARC) platform

- Population Health Analytics and Clinical Insights Support + MSO Support Standing Up and Running the ACO, Including Care Management Design and Implementation

- One and two above plus downside risk protection

- One through three above with capitated payments management to distribute payments to participating providers

We would love to hear from you, potentially become your MSSP partner, and accelerate your broader value-based care journey. Please do not hesitate to reach out at info@copehealthsolutions.com or 213-259-0245.

To learn more about our perspective on Medicare ACOs and how we differ from other VBC enablers, we encourage you to read the following thought leadership article: It’s Time For ACO Participants To Invest In Themselves

Footnote:

1 https://www.cms.gov/files/document/2024-shared-savings-program-fast-facts.pdf