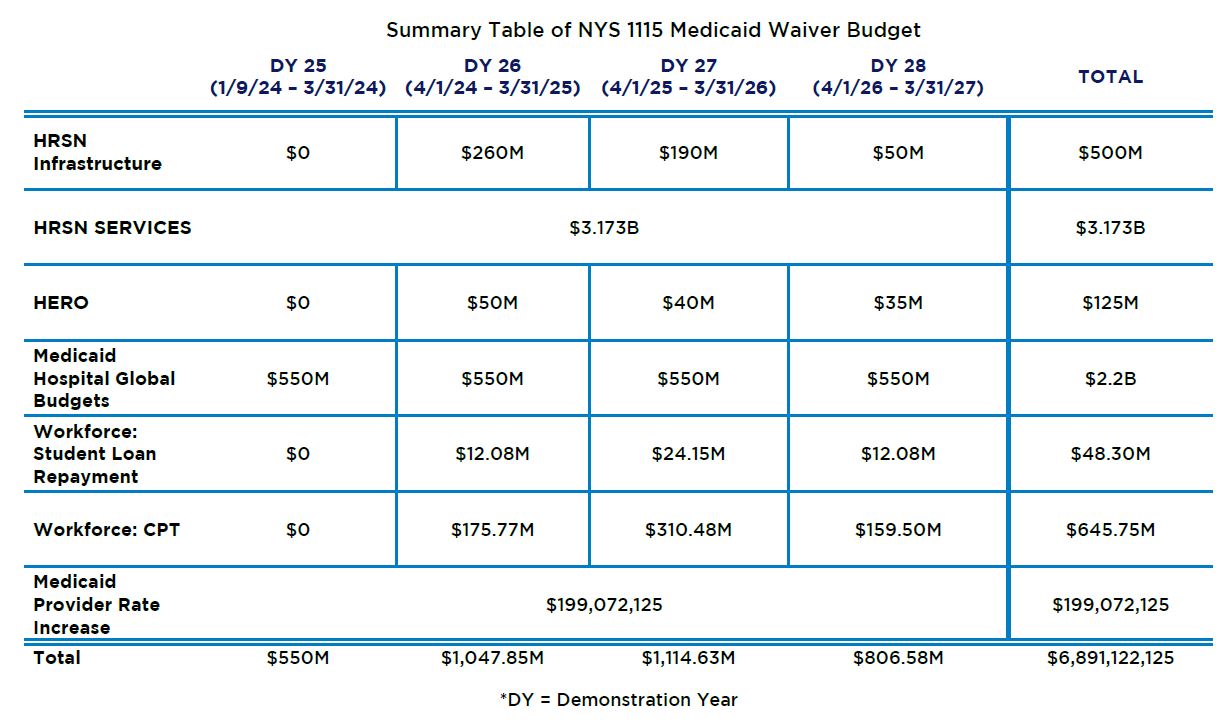

On January 9, 2024, CMS approved a just under $7 billion amendment to New York’s Medicaid 1115 Waiver, allowing the state to make investments in Medicaid initiatives that expand access to primary and behavioral health, address health-related social needs (HRSN) to reduce disparities and promote health equity, and strengthen the healthcare workforce. The term of the demonstration amendment will run through March 31, 2027.

Through this innovative waiver amendment, New York State is aligning itself with CMS’ goals and new programs to promote value-based payment (VBP) strategies through two Center for Medicare and Medicaid Innovation (CMMI) models: Making Care Primary (MCP) for upstate New York and States Advancing All-Payer Health Equity Approaches and Development (AHEAD) for downstate New York.

The new initiatives announced as key components of the waiver are outlined below:

- Health-Related Social Needs (HRSN)

- Component #1: Infrastructure – up to $500 million

- New York is provided authority to create Social Care Network (SCNs) in each of the state’s nine regions

- Component #2: HRSN Services – up to $3.173 billion

- The waiver amendment creates a two-tiered system of certain benefits and services that address HRSNs that are authorized to be covered

- Component #1: Infrastructure – up to $500 million

- Health Equity Regional Organization (HERO) – up to $125 million

- The HERO will be contracted as a statewide entity that will be responsible for conducting regional assessments based on data reporting and analytics and inform future VBP goals and strategies

- Medicaid Hospital Global Budget Initiative – up to $2.2 billion over the demonstration amendment term, or $550 million annually

- The goal of this initiative is to invest in safety net hospitals to propel them towards success in population health

- The eligibility criteria for hospitals to participate in this initiative are below:

- Private Not-For-Profit Hospitals in the Bronx, Kings, Queens, and Westchester Counties with a Medicaid and Uninsured Payor Mix of at least 45 percent;

- Private Not-For-Profit Hospitals with an average operating margin that is less than or equal to 0 percent over the past four years (Calendar Years 2019-2022) based on audited Hospital Institutional Cost Reports (excluding COVID relief funding and state-only subsidy); and

- Private Not-For-Profit Hospitals or their affiliates that received state-only subsidies due to financial distress in State Fiscal Years 2023 and/or 2024.

- If NYS applies for and is approved for the AHEAD model, it will have satisfied the requirement to produce a Hospital Global Budget Model plan. If not, NYS must submit its own plan independent from the AHEAD model.

- Workforce – up to $694.05 million

- There are two workforce initiatives that aim to bolster workforce recruitment and retention and combat shortages for practitioners who serve Medicaid populations

- Initiative 1: Student Loan Repayment

- Initiative 2: Career Pathways Training (CPT)

- NYS will work with Workforce Investment Organizations (WIOs) in up to three regions

- Medicaid Provider Rate Increase – net must amount to $199,072,125 by March 31, 2027

- NYS will implement at least a 2-percentage point payment increase for Medicaid managed care and fee-for-service services, and the state can implement in any of the demonstration years

If you are interested in learning more about the waiver or how your organization can participate, please reach out to us at info@copehealthsolutions.com or 213-295-0245 . We are excited to meet with you and learn how CHS can help your organization succeed in value based payment for Medicare, Medicaid or commercial lines of business.