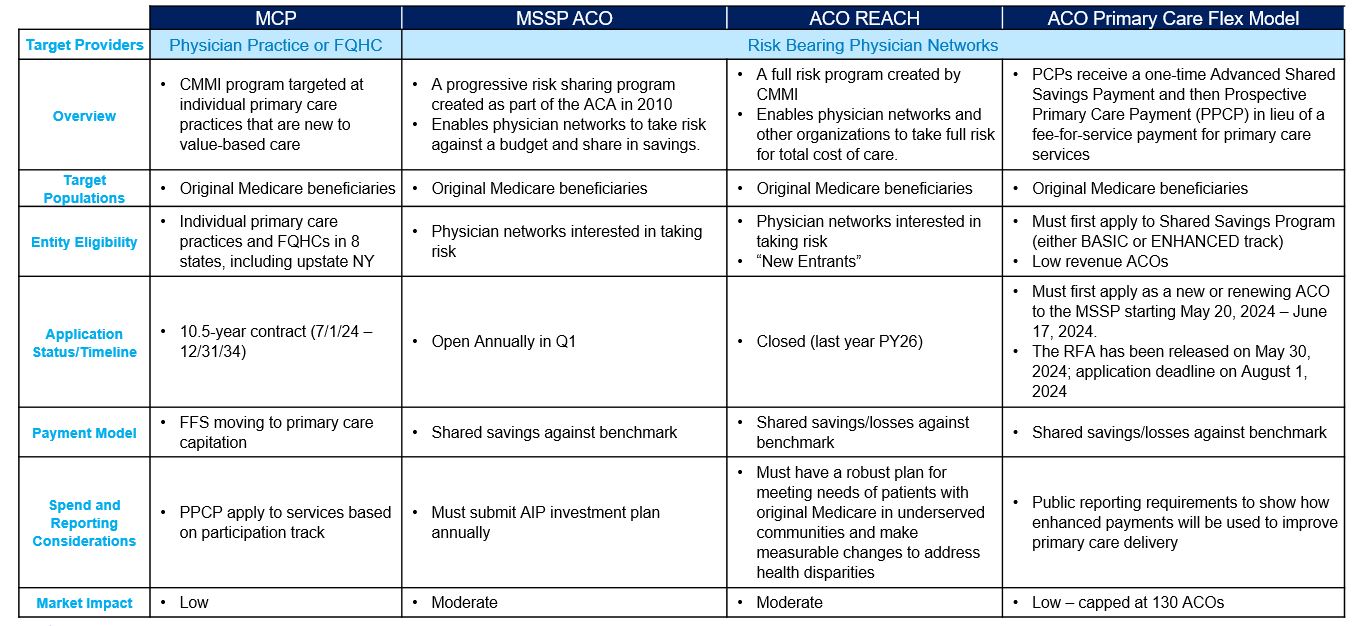

Recently we shared key considerations for organizations considering or planning to apply to the Medicare Shared Savings Program (MSSP), a progressive risk sharing program created as part of the Affordable Care Act in 2010 that enables physician networks to take risk against a budget and share in potential savings by creating Accountable Care Organizations (ACOs).

On March 19, CMS announced a new voluntary model within MSSP called the ACO Primary Care Flex Model that introduces targeted investment in primary care that begins on January 1, 2025 and runs for five years through December 31, 2029.

In July 2024, CMS has extended the ACO PC Flex Model Application submission deadline from August 1 until August 23, 2024 at 11:59pm EST

Below are four key elements on the model:

- Eligibility Criteria – both new and existing ACOs may participate

- This model is only for ACOs who participate in MSSP, and ACOs that choose to join ACO Primary Care Flex will participate in both together

- Only “low revenue ACOs” may participate in ACO Primary Care Flex, defined as ACOs whose total Medicare Parts A and B fee-for-service revenue of its ACO participants is less than 35% of the total Medicare Parts A and B fee-for-service expenditures for the ACO’s assigned beneficiaries, based on data for the most recent calendar year for which 12 months of data are available

- CMS has released an RFA that defines further eligibility criteria, and CMS expects around 130 ACOs to join the model

- Payment Structure

- The model includes a one-time Advanced Shared Savings Payment of $250,000 for each ACO participant

- ACO participants will also receive a monthly Prospective Primary Care Payments (PPCP) to replace FFS reimbursement for most primary care services, calculated based off 1) an at-risk county base rate (average primary care spend in given county) and 2) payment enhancements to be determined by the ACO’s patient population that are not at risk

- ACOs cannot jointly participate in ACO Primary Care Flex and receive the MSSP Advance Investment Payments (AIPs)

- Model Application and Timeline

- MSSP ACO Phase 1: May 20 – June 17, 2024

- ACO Primary Care Flex Model application window: May 30 – August 1 2024

- ACO Primary Care Flex Model Signing Date: Q4 2024

- CMS Announces ACOs Selected for Participation in ACO PC Flex Model: October 17, 2024

- Phase 2 Application Submission October 18-29, 2024

- PC Flex ACOs Submit Spend Plan & Non-Physician Practitioner Roster

- Request for Information Period: November 8-18, 2024

- PC Flex ACOs Submit Draft Repayment Mechanism Documentation

- Final Application Dispositions: December 5, 2024

- CMS Communicates Final ACO PC Flex Model Application Dispositions

- Signing Event and Final Submission: December 6-12, 2024

- PC Flex ACOs Submit Final Repayment Mechanism Documentation

- Model Performance Period: January 1, 2025 – December 31, 2029

- How to Apply

- Interested organizations must have first applied to MSSP, either as a new or renewal applicant, in the Phase 1 application window from May 20 – June 17, 2024

- In the MSSP application, organizations can confirm their interest

- CMS released an RFA on May 30 2024; deadline is August 1, 2024

Bottom Line:

The model is a particularly good fit for ACOs with smaller medical groups, federally qualified health centers (FQHCs) and Rural Health Clinic participants that possess limited care management and health IT capabilities or limited experience operating in a value-based environment and closing health-related social needs (HRSN) gaps. The investments made available to ACO participants are designed to help them both build out the capabilities and gain the experience needed to succeed in riskier VBP arrangements.

If you are considering joining an MSSP ACO, CHS can help whether you are a good fit for the ACO Primary Care Flex model. Our team of experts can support your team in configuring your arrangement to best mitigate risk and maximize reward while subsequently designing a roadmap to optimize your operational and care models. Please do not hesitate to reach out at info@copehealthsolutions.com or 213-259-0245.